Japan has not one but TWO tax-exempt retirement accounts: iDeCo and NISA. This video explains the difference, who can use them, who SHOULD use them, and if you watch to the end you should understand them well enough to decide on your investment strategy in Japan.

___________________________________________________

See the RetireJapan main site for more blog posts and information: https://www.retirejapan.com/

Get our FREE guide to personal finance in Japan here: https://retirejapan.gumroad.com/

Join our forum to ask questions and discuss personal finance in a friendly environment: https://www.retirejapan.com/forum/

Follow RetireJapan on Twitter: https://twitter.com/retirejapan_OG

Or Facebook: https://www.facebook.com/RetireJapan

00:00 Introduction

00:45 What are NISA and iDeCo for?

02:04 What about US citizens?

03:29 The benefits of iDeCo

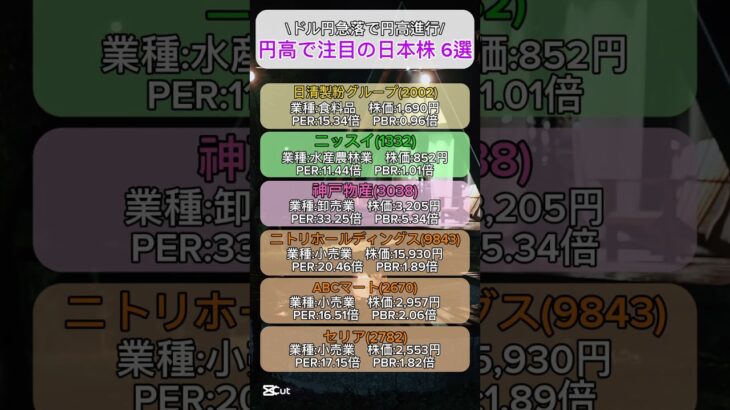

04:06 The benefits of NISA

04:43 The limitations of iDeCo

07:04 The limitations of NISA

07:42 Who should use NISA?

08:17 Who should use iDeCo?

09:07 What does Ben do?

10:02 Ben’s recommendation for you

Gear:

Sony ZV-E10 camera: https://amzn.to/3w6Xvlb

Sony ECM-B1 mic: https://amzn.to/3GPXOa8

Sigma 16mm 1.4 lens: https://amzn.to/3IAKR5c

#Japan #investing #NISA #personalfinance #stockmarket #iDeCo #mutual funds #投資信託 #ETF